Is my US health insurance valid in other countries?

U.S. Medicare and Medicaid do not cover medical costs overseas. Private U.S. insurance policies also might not cover any or all expenses. Check with your insurance before traveling to see if it provides coverage overseas. More information is also available on the CDC insurance page.

U.S. health insurance plans typically do not cover regular and routine medical care required overseas. This means your health insurance won't pay for care if you need to visit a doctor for a prescription medicine, or if you need treatment for a condition that is not considered an emergency.

Your Compass Rose Medicare Advantage Plan covers care even when you're traveling outside the United States just as if you were in the United States. UnitedHealthcare will reimburse you for any covered services or prescriptions you may need while traveling minus any copays that may apply.

You might be able to get some emergency coverage abroad to an extent, but you won't be able to visit a doctor for a routine procedure or buy prescription medication and expect a reimbursem*nt. Private insurance might or might not offer coverage overseas, but again, it depends on the plan you have.

Make sure you have a plan to get care overseas, in case you need it. Consider buying additional insurance that covers health care and emergency evacuation, especially if you will be traveling to remote areas. Enroll with the Department of State's Smart Traveler Enrollment ProgramExternal Link (STEP).

The U.S. government does not pay overseas medical bills. The patient must pay all hospital and other expenses. You can find lists of doctors and hospitals in the country you are visiting. Check the website of the U.S. embassy in the country you are visiting.

| Policy Name | Forbes Advisor India Rating | Covid-19 Coverage |

|---|---|---|

| Bajaj Allianz Bharat Bhraman Insurance Policy | 4.5 | Yes |

| Reliance Travel Care Policy – Senior Citizens | 4.5 | Yes |

| ICICI Lombard Overseas Travel Insurance | 4.0 | Yes |

| Royal Sundaram Travel Secure-Leisure Trip | 3.5 | No |

How much does international health insurance cost? The annual cost of an international medical insurance plan will range from as low as $500, with limited benefits, to as much as $8,000 for a comprehensive global medical insurance policy, including coverage in the USA. The average cost is $5,500 per year.

United Healthcare: The UHC Choice Plus Plan does not contract with any international providers or facilities. There is no coverage for non-emergency medical coverage unless a UHC participant is traveling outside of the U.S. for 45 days or more.

How much travel medical insurance do you need? Squaremouth, a travel insurance comparison site, recommends buying at least $50,000 in emergency medical coverage for international travel. For travelers going on a cruise or to a remote destination, the site recommends at least $100,000 in coverage.

Can Aetna be used internationally?

Enjoy peace of mind wherever you travel with global medical coverage. We have over 30 years experience in international health insurance. And more than 500,000 members trust us with their care worldwide.

Most Blue Cross Blue Shield members can rest easy since Blue Cross Blue Shield coverage opens doors in all 50 states and is accepted by over 90 percent of doctors and specialists.

Special care if you become ill or injured while traveling

Contact the nearest U.S. Embassy or Consulate for a list of local healthcare providers and medical facilities. If your illness is serious, consular officers can help you find medical assistance. If you want, they can inform your family and friends.

Be aware that you will likely have to pay out of pocket for any medical treatment, even if your insurance company provides international health care coverage. A visit to the emergency room can be free or cost only a nominal fee, or it can be expensive, depending on where you are and what treatment you need.

For the most part, your U.S.-based medical insurance provider will not cover your medical treatment when you're abroad. If you want peace of mind while you're on a trip away from your home country, a travel medical insurance plan is your best bet.

If a medical emergency occurs, the flight crew notifies ground-based medical support for guidance. “The flight crew members are trained in cardiopulmonary resuscitation (CPR) and are able to administer lifesaving medications and equipment available in the emergency kits,” said Stahl.

How Do I See a Doctor in a Foreign Country? If you have an international health insurance plan, or travel insurance, they should provide you with an emergency medical assistance number you can call to help you arrange for a doctor visit. To schedule an appointment, first contact your insurance company.

Americans take 60 million international trips each year, and as many as half of those travelers bring back unwanted souvenirs in the form of gastrointestinal illnesses, fevers, skin disorders and other ills. That's why physicians should routinely ask patients if they've recently been out of the country, says Dr.

International health insurance is designed to provide a comprehensive level of health care to those relocating from their home country for a sustained period of time, whereas travel insurance provides cover for emergency treatment while you are in another country for a shorter space of time.

The ten best international health insurance companies are VUMI, Cigna Global, AXA, MSH International, GeoBlue, Allianz Care, IMG Global, April International, Now Health International, and BUPA Global. Tip: Keep shopping for health insurance simple by getting free quotes to compare multiple companies at once.

What is worldwide coverage insurance?

What Is Worldwide Coverage? Worldwide coverage is a characteristic of some insurance policies provided by insurance companies that globally covers the insured business or individual against loss or damage.

The international medical plan from Aetna costs, on average, $100 to $300 per month. If you want to find the right plan at a price you can afford, eHealth can help. eHealth can help you find an Aetna insurance plan that is in your price range, without sacrificing the quality of your coverage.

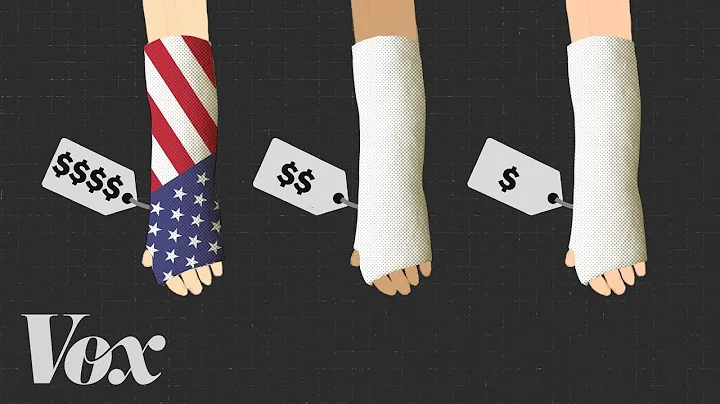

The United States: the world's highest medical expenses

The United States has the most expensive healthcare system of any country.

International health insurance can cost from $200 to $900 per month, with an average of $500. However, the final cost of an international health insurance policy depends on many factors.

- United States.

- Brazil.

- India.

- Ireland.

- Philippines.

- United Kingdom.

- Colombia.

References

- https://www.cnbc.com/select/medical-debt-credit-report/

- https://www.bcbs.com/articles/coverage-goes-where-you-go-travel-worry-free-blue-cross-blue-shield

- https://www.debt.org/medical/doctor-visit-costs/

- https://www.pgpf.org/blog/2023/11/the-share-of-americans-without-health-insurance-in-2022-matched-a-record-low

- https://www.ricksteves.com/travel-tips/health/medical-care-in-europe

- https://www.usnews.com/insurance/travel/europe-travel-insurance

- https://help.hopper.com/en_us/cancelling-your-flight-due-to-death-or-illness-BJwq8F_tv

- https://www.forbes.com/advisor/in/travel-insurance/

- https://it.usembassy.gov/u-s-citizen-services/doctors/emergencies/

- https://www.forbes.com/advisor/health-insurance/what-happens-if-you-dont-have-health-insurance/

- https://www.internationalinsurance.com/aetna/

- https://www.valuepenguin.com/platinum-health-insurance-guide

- https://www.consumerfinance.gov/ask-cfpb/what-should-i-do-if-i-cant-pay-a-medical-bill-en-2125/

- https://morganlawyers.com/faq/does-bankruptcy-put-people-at-risk-for-deportation/

- https://www.samhsa.gov/sites/default/files/health-insurance-how-do-i-get-pay-use-with-notes.pdf

- https://visitworld.today/blog/1521/how-much-does-international-health-insurance-cost

- https://www.quora.com/If-I-travel-to-a-country-in-Europe-where-healthcare-is-free-and-while-there-I-need-emergency-surgery-will-I-be-covered

- https://nayyarssolicitors.co.uk/extraordinary-circumstances-delayed-flight/

- https://benefits.georgetown.edu/coverage-while-traveling/

- https://www.quora.com/Can-having-unpaid-medical-bills-prevent-you-from-re-entering-the-US-in-the-case-of-non-citizens

- https://www.experian.com/blogs/ask-experian/can-debt-follow-you-if-you-move-to-another-country/

- https://www.tchabitat.org/blog/credit_scores_medical_debt_and_buying_a_home

- https://usafacts.org/articles/how-many-people-skip-medical-treatment-due-to-healthcare-costs/

- https://www.bankrate.com/personal-finance/debt/reset-old-debt/

- https://it.usembassy.gov/u-s-citizen-services/doctors/

- https://www.nerdwallet.com/article/travel/travel-medical-insurance-emergency-coverage-travel-internationally

- https://www.usatoday.com/money/blueprint/travel-insurance/travel-medical-insurance/

- https://www.medicoverage.com/health-insurance-blog/news/obamacare-health-plans-am-i-covered-when-i-travel

- https://www.cnbc.com/select/does-medical-debt-affect-credit-score/

- https://www.investopedia.com/articles/personal-finance/080615/6-reasons-healthcare-so-expensive-us.asp

- https://time.com/personal-finance/article/what-happens-when-medical-bills-go-to-collection/

- https://www.hhs.gov/answers/medicare-and-medicaid/who-is-eligible-for-medicaid/index.html

- https://health.mit.edu/my-mit/internationals/healthcare-united-states

- https://www.allianzcare.com/en/about-us/blog/the-difference-between-international-health-and-travel-insurance.html

- https://www.allianztravelinsurance.com/travel/planning/do-I-need-travel-insurance-if-I-have-health-insurance.htm

- https://nycdepartmentoffinance.powerappsportals.us/forums/general-discussion/4ee525e5-73fe-ee11-a73d-001dd8305ba3

- https://www.peoplekeep.com/blog/top-25-health-insurance-companies-in-the-u.s

- https://www.airlinepilotforums.com/pilot-health/139819-can-airlines-ask-about-medical-history.html

- https://www.cheapair.com/help/flights/can-i-get-a-refund-on-my-airline-ticket-if-i-get-sick-and-have-a-doctors-note/

- https://www.usatoday.com/money/blueprint/travel-insurance/what-does-travel-insurance-cover/

- https://retiree.uhc.com/content/dam/retiree/pdf/compassrose/Compass-Rose-Foreign-Travel-Brochure.pdf

- https://www.marketwatch.com/guides/insurance-services/travel-medical-insurance/

- https://www.medicare.gov/Pubs/pdf/11037-Medicare-Coverage-Outside-United-States.pdf

- https://www.marketwatch.com/guides/insurance-services/travel-insurance-cost/

- https://www.ziprecruiter.com/Salaries/What-Is-the-Average-Physician-Salary-by-State

- https://www.forbes.com/advisor/credit-cards/what-happens-to-unpaid-credit-card-debt-if-you-move-abroad/

- https://www.pacificprime.com/blog/international-health-insurance-top-10-providers.html

- https://thepointsguy.com/guide/airline-change-and-cancellation-policies/

- https://www.generalitravelinsurance.com/travel-resources/not-covered.html

- https://www.quora.com/Can-overseas-debt-collectors-reach-you-if-you-move-to-another-country-and-change-your-name

- https://time.com/personal-finance/article/do-medical-bills-affect-your-credit/

- https://www.cms.gov/medical-bill-rights

- https://www.internationalinsurance.com/resources/find-a-doctor.php

- https://usafacts.org/articles/how-much-money-do-doctors-make-in-the-us/

- https://www.hopkinsmedicine.org/health/wellness-and-prevention/medical-information-for-americans-traveling-abroad

- https://www.mdlinx.com/article/are-older-doctors-wiser-not-necessarily/01FmC1yV5CNRDrQpaQpy6R

- https://www.americanvisitorinsurance.com/blog/us-citizens-visiting-europe.asp

- https://dreamingdr.com/healthcare-insurance-dominican-republic/

- https://wwwnc.cdc.gov/travel/page/health-care-during-travel

- https://www.bankrate.com/personal-finance/debt/medical-debt-and-credit-reports/

- https://www.moneymanagement.org/blog/can-credit-card-debt-follow-me-overseas

- https://www.nerdwallet.com/article/travel/can-you-get-your-money-back-for-nonrefundable-plane-tickets

- https://einsteinmed.edu/research/highlights/49/surprise-souvenirs-why-clinicians-should-always-ask-about-foreign-travel/

- https://www.investopedia.com/articles/personal-finance/112315/5-airlines-offer-refundable-plane-tickets.asp

- https://www.nerdwallet.com/article/finance/medical-bills-on-credit-report

- https://www.unitedhealthgroup.com/careers/en/work.html

- https://www.skuad.io/blog/an-overview-of-countries-that-offer-free-healthcare

- https://www.cbsnews.com/news/how-much-travel-insurance-do-you-need/

- https://www.ehealthinsurance.com/resources/individual-and-family/how-much-does-aetna-health-insurance-cost-per-month

- https://www.avvo.com/legal-answers/does-having-unpaid-medical-bills-as-a-non-resident-5860604.html

- https://www.blinctrip.com/help/manage-trip/cancellation/flight-cancellation-due-to-health-issues

- https://www.comparetravelinsurance.com.au/travel-insurance-tips/pre-existing-medical-conditions

- https://www.urmc.rochester.edu/encyclopedia/content.aspx?contenttypeid=85&contentid=P01455

- https://www.internationalinsurance.com/resources/healthcare-costs-in-the-usa.php

- https://www.squaremouth.com/travel-insurance-benefits/cancel-for-medical-reasons

- https://www.msh-intl.com/en/medical-expenses-abroad-countries-most-expensive.html

- https://www.usnews.com/insurance/travel/does-my-health-insurance-cover-international-travel

- https://travel.state.gov/content/travel/en/international-travel/before-you-go/your-health-abroad.html

- https://www.healthsystemtracker.org/brief/the-burden-of-medical-debt-in-the-united-states/

- https://www.thesuperbill.com/blog/how-to-negotiate-medical-bills-a-step-by-step-guide

- https://www.template.net/edit-online/260462/medical-letter-for-airline-refund

- https://www.investopedia.com/terms/w/worldwide-coverage.asp

- https://expatfinancial.com/healthcare-information-by-region/european-healthcare-system/

- https://www.nerdwallet.com/article/travel/does-my-health-insurance-cover-international-travel

- https://www.internationalinsurance.com/health/systems/

- https://test.int.myuhc.com/content/dam/myuhc/pdfs/global-expats/ExpatriateInpat%20Member%20Welcome%20Guide%20-%20resources%20page.pdf

- https://www.webpt.com/blog/times-when-you-absolutely-must-issue-a-patient-refund

- https://www.visitorscoverage.com/blog/unpaid-medical-bills-can-be-a-disaster/

- https://phassociation.org/wp-content/uploads/2017/01/Patients-toolkit-PH-TemplateLetter-Permissionto-Cancel-Flight.docx

- https://blog.healthsherpa.com/what-to-do-health-insurance-wont-pay/

- https://www.marketwatch.com/guides/insurance-services/schengen-visa-travel-insurance/

- https://www.ehealthinsurance.com/resources/affordable-care-act/considered-illegal-health-insurance

- https://wwwnc.cdc.gov/travel/yellowbook/2024/air-land-sea/responding-to-medical-emergencies-when-flying

- https://www.pgpf.org/blog/2024/01/why-are-americans-paying-more-for-healthcare

- https://www.internationalinsurance.com/health/

- https://www.healthline.com/health-news/medical-emergency-on-plane

- https://www.usnews.com/insurance/travel/international-travel-insurance

- https://www.healthcare.gov/medicaid-chip/

- https://www.progressive.com/answers/travel-insurance-medical-coverage/

- https://www.medical-air-service.com/blog/how-to-handle-medical-emergencies-on-board-a-plane-what-options-are-available-for-the-critically-ill-or-injured_8058.html

- https://www.citizensadvice.org.uk/consumer/insurance/types-of-insurance/travel-insurance1/accidents-and-illness-when-travelling-independently/

- https://www.equifax.co.uk/resources/loans-and-credit/what-happens-to-credit-history-when-moving-abroad.html

- https://fortune.com/2024/01/17/what-does-law-require-airlines-canceled-flights-refunds-compensation/

- https://www.talktomira.com/post/what-should-i-do-if-i-can-t-afford-a-doctor-s-visit

- https://blog.healthsherpa.com/free-or-low-cost-medical-care/

- https://upsolve.org/learn/consequences-not-paying-collections/

- https://www.talktomira.com/post/the-cost-of-a-doctor-visit-without-insurance

- https://www.westhealth.org/news/112-million-americans-struggle-to-afford-healthcare/

- https://www.consolidatedcreditcanada.ca/ask-the-experts/will-my-bad-credit-and-debt-follow-me-abroad/

- https://www.hhs.texas.gov/services/health/county-indigent-health-care-program

- https://help.ryanair.com/hc/en-mt/articles/12896441081617-I-couldn-t-travel-due-to-a-serious-or-life-threatening-illness-Can-I-get-a-refund

- https://dan.org/health-medicine/travelers-medical-guide/planning-and-preparedness/medical-fitness-to-travel/

- https://oaktreelaw.com/news/blog/what-is-the-california-statute-of-limitations-on-medical-debt/

- https://www.cnn.com/cnn-underscored/money/europe-travel-insurance

- https://www.quora.com/Can-you-get-in-trouble-if-airline-finds-out-your-doctors-note-is-fake

- https://travel.state.gov/content/travel/en/international-travel/before-you-go/your-health-abroad/Insurance_Coverage_Overseas.html

- https://www.easemytrip.com/blog/how-to-get-a-full-refund-on-flight-bookings

- https://www.aetna.com/individuals-families/international-insurance.html

- https://www.hopkinsmedicine.org/health/wellness-and-prevention/what-to-do-if-you-get-sick-while-traveling

- https://www.immihelp.com/public-vs-private-hospitals-your-options-in-the-us/

- https://www.cbsnews.com/news/medical-debt-credit-score-what-to-know/

- https://www.marketwatch.com/guides/insurance-services/trip-cancellation-compensation/